Bank Increases Load Capacity by 450% to Deal with Business Growth

How the Need for System Performance Testing Arose

The bank’s management made a strategic decision to develop their remote banking services in-house and to try and bring the system to a higher level in the ratings. Three platforms (online web banking, iOS and Android apps) were subject to renovation.

The situation was aggravated by the fact that at that moment the banking group was undergoing integration processes, and the load on the system increased in step-ups. It became clear that the system was not ready for such a load: there was a system crash on a peak workload day, a payday.

Since the remote banking services system operates in an environment of integration with related systems (accounting, active operations, sales channels, terminal networks, etc.), to identify the problem area, specialists need to evaluate the whole complex of these components.

In that case it was necessary to find out which system malfunctioned, what particular problems disrupted the work of the client Internet banking.

In order to deal more quickly with the critical task of finding the problem, the CIO and CTO of the bank decided to outsource the task.

Urgent Solution

The first step of the PFLB team was to issue several recommendations that helped the bank survive the next banking day without system failures.

Our best engineers immediately engaged in an investigation of the system overload. We found 200+ system errors that impaired both the system’s performance and its stability.

After having increased database session timeout from 5 seconds to 30, we made sure there will be no system crashes in the next payroll period by conducting performance tests right before it. Thus, we located one of the most critical bottlenecks and saved the immediate future of the bank’s clients. We also ran stress testing to be able to predict the behavior of the system from the next peak day and to see if it will stand the load.

At the same time, we actively collaborated with the bank’s staff to form a pool of recommendations needed to be implemented to stabilize the system. We helped to prioritize these tasks and began the process of removing bottlenecks. Overall, it took us less than 2 weeks.

The bank’s remote banking services system was under active development, which could have caused changes in system performance during the release of new versions. The client made a strategic decision to build and implement a performance testing process as a routine part of their business process to minimize the risks. We were eager to help, and that is how the second stage of the project started.

Sustainable Solution

Speaking strategically, our client wanted the system to have a load reserve that would ensure system stability with further user number increases. We worked on this stage of the project for half a year, because the bank system was expanding and required a full-fledged performance testing process to be designed, introduced and implemented.

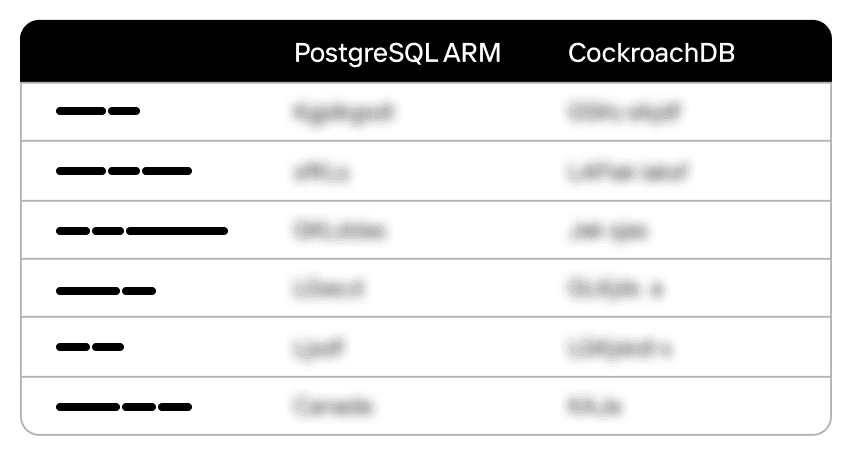

During the second phase of the project, which lasted for six months, the following results were achieved:

Conclusions

The system now has load capacity of up to 450% of the production environment (Learn more about what is capacity testing). Now the bank can freely perform critical business processes without a threat of facing a system crash.

During the project, the bank’s in-house team accumulated enough skills to be able to identify the causes and locations of bottlenecks, and thus, performance testing and localizing performance issues is since then the IT department’s function.

Since the bank’s policy was initially aimed at in-house dev, embedding performance testing into the development process was a valuable experience that increased the maturity of the bank’s development culture.

Related insights in case studies

Benchmark Testing Case Study: How PFLB Validated Chainguard Docker Container Performance

Chainguard specializes in providing highly secure Docker container images — regularly updated, tightly managed, and designed to minimize vulnerabilities. While their reputation for security is well-established, Chainguard wanted to ensure their containers also delivered competitive performance. After all, strong security is crucial, but it shouldn’t slow you down. Client Goal Chainguard needed clear, objective proof […]

From Weeks to Hours: Accelerating Data Masking and Enabling Easy B2B Data Sharing for a Leading Bank

A leading bank, ranked among the top 20 in its market, provides services to millions of customers daily. Staying at the forefront of this competitive market requires not only stable and updated infrastructure but also rapid feature delivery to maintain the highest service quality. Challenge The bank faced a critical challenge in enabling safe sharing […]

Leading Oil & Gas Innovator, NOV Excels with Real-Time Drilling Data After Load Testing

NOV, a renowned global provider of equipment, components, and IT products for the oil and gas industry, which is located in Texas, USA, empowers extraction companies worldwide with innovative technological solutions that enable the safe and efficient production of abundant energy while minimizing environmental impact. Under its CTES brand, NOV offers a range of IT […]

From Hundreds to Thousands: Scaling MEFA Pathway Software for Mass Student Registration

FolderWave, Inc. is a leading digital services provider in the Massachusetts e-learning sector. It aids millions of students in researching and planning a job-oriented education. The company delivers IT solutions, platforms, and services in partnership with notable non-profit organizations like MEFA Pathway and College Board, which connect a vast network of colleges, schools, and universities […]

Be the first one to know

We’ll send you a monthly e-mail with all the useful insights that we will have found and analyzed

People love to read

Explore the most popular articles we’ve written so far