Our client is one of the largest commercial banks, with European offices and state participation.

The bank has its own payroll system which is used to automate the issue, maintenance, and cancellation of agreements and their conditions, as well as processes related to handling the following data:

This salary system is crucial for the employees’ convenience, as payments are made directly into their bank accounts.This is also an advantage for both the bank and the employers.

To distribute money from companies into employees’ salary accounts, dozens of registry versions must be received and sent to different companies through various integration channels. Also, the bank system has a complicated framework of verification at each stage. In addition, the salary system remits a portion of employees’ pay to a tax service and other government entities. A failure in the system would result in millions of people not receiving their money.

The system provides services for the payroll programs of the largest European companies.

The salary program service system works on DBMS Oracle, Oracle BPM Suite platform, and the WebLogic interface.

Task

The bank had a goal to minimize performance and resiliency risks in IT infrastructure and salary program systems, such as possible disruptions in payroll card services, payroll accounting delays, and system failures during registry processing.

PFLB provided performance testing of payroll systems. The testing challenge was to understand the structure of component interaction given a variety of registry types and a large status model.

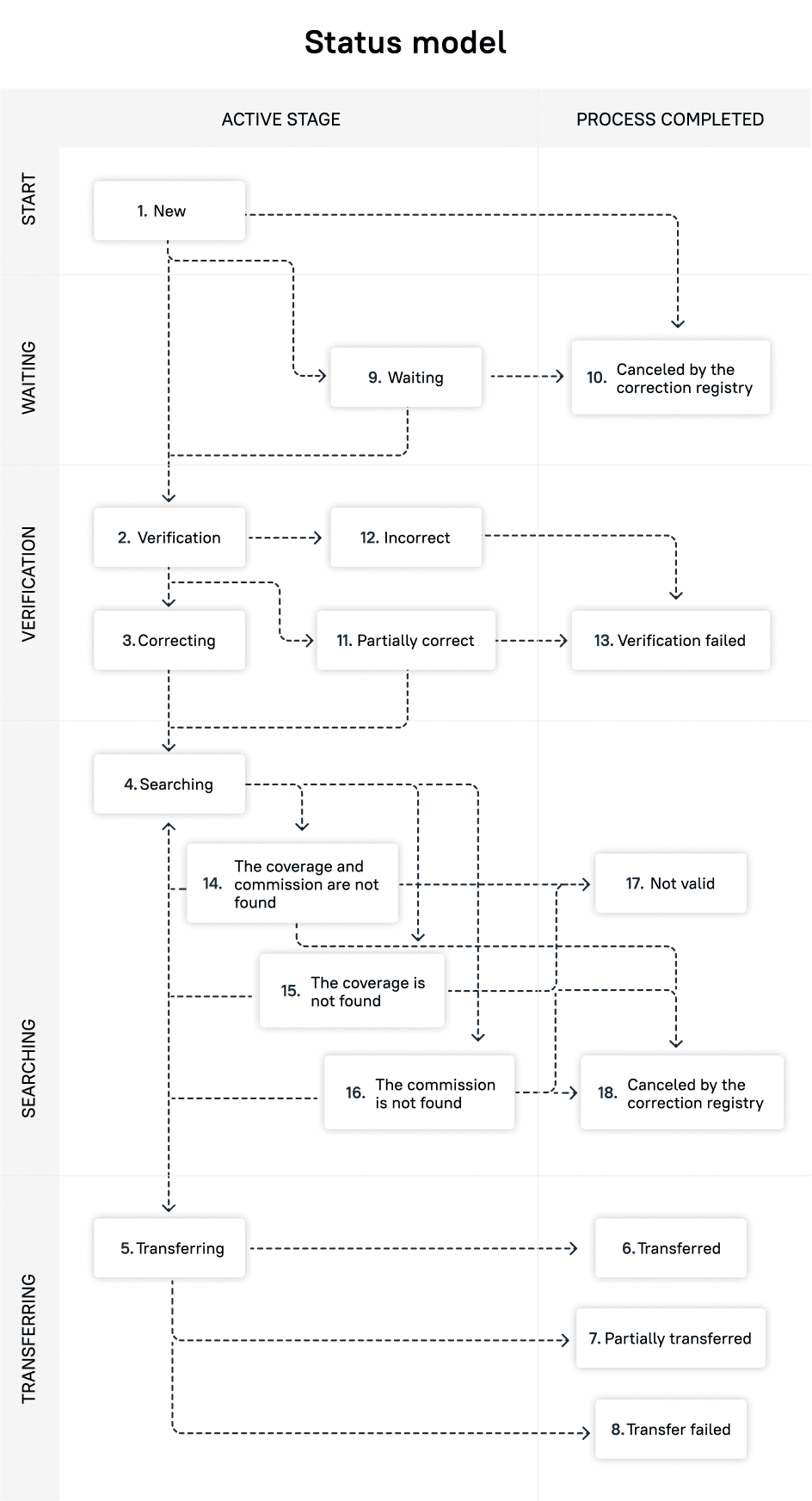

During system load testing, registries passed through several processing stages in the system and we had to consider them all. At each stage, a registry can be assigned a status according to the business process model, making it possible to have a maximum of 12 transaction statuses:

As a part of the task, our testing team had to do the following:

Solution

PFLB’s specialists organized the comparison of system release load testing performance. Each release contained at least three changes in system functionality. During the tests, we measured the impact of each release on system performance; changes that did not pass a check were not included in the release.

Besides, we wrote 43 test registry generators in Python.

During testing, our team tracked business process status transitions of all registries and detected status defects.

DBMS performance was tracked using Oracle Automatic Workload Repository.

For monitoring purposes, we used Telegraf, InfluxDB, Grafana, and self-written scripts in Python and Go.

Benefits for the Client

PFLB engineers have been performing load testing for financial systems for more than five years. We have prevented numerous system failures and provided timely payroll for large clients, reducing financial and reputational losses.

Our services allow clients to address releases with performance degradation, preventing possible decreased system reliability before production deployment. This enables banks to minimize risks and reduce losses of funds when operating with salary clients. Punctual testing of the payroll system provides significant benefits and savings to businesses.

Related insights in case studies

Benchmark Testing Case Study: How PFLB Validated Chainguard Docker Container Performance

Chainguard specializes in providing highly secure Docker container images — regularly updated, tightly managed, and designed to minimize vulnerabilities. While their reputation for security is well-established, Chainguard wanted to ensure their containers also delivered competitive performance. After all, strong security is crucial, but it shouldn’t slow you down. Client Goal Chainguard needed clear, objective proof […]

From Weeks to Hours: Accelerating Data Masking and Enabling Easy B2B Data Sharing for a Leading Bank

A leading bank, ranked among the top 20 in its market, provides services to millions of customers daily. Staying at the forefront of this competitive market requires not only stable and updated infrastructure but also rapid feature delivery to maintain the highest service quality. Challenge The bank faced a critical challenge in enabling safe sharing […]

Leading Oil & Gas Innovator, NOV Excels with Real-Time Drilling Data After Load Testing

NOV, a renowned global provider of equipment, components, and IT products for the oil and gas industry, which is located in Texas, USA, empowers extraction companies worldwide with innovative technological solutions that enable the safe and efficient production of abundant energy while minimizing environmental impact. Under its CTES brand, NOV offers a range of IT […]

From Hundreds to Thousands: Scaling MEFA Pathway Software for Mass Student Registration

FolderWave, Inc. is a leading digital services provider in the Massachusetts e-learning sector. It aids millions of students in researching and planning a job-oriented education. The company delivers IT solutions, platforms, and services in partnership with notable non-profit organizations like MEFA Pathway and College Board, which connect a vast network of colleges, schools, and universities […]

Be the first one to know

We’ll send you a monthly e-mail with all the useful insights that we will have found and analyzed

People love to read

Explore the most popular articles we’ve written so far